A recent article by HBR explains how everyone has their own style of leadership, ranging between powerful and attractive. Powerful leaders can be described as confident and assertive, but also potentially arrogant and proud. Attractive leaders on the other hand can be understanding and kind, but also meek or weak.

The ideal position isn’t necessarily to try to take a middle ground, but to learn to be flexible depending on the situation. If you need to be more powerful then maybe try speaking first in a meeting, and if you need to be more attractive then try asking more questions. Having a think about what your leadership style is now, and being mindful of which leadership style is more suitable depending on context, can help you to take the lead more effectively in the future.

Dear reader,

This year has been very hard to plan for. Innumerable events have been cancelled, re-planned, re-cancelled and further delayed. As we enter the final month of the year, it it time that we start to turn our minds to next year. Whatever next year might bring, I hope that we learn as much as we did this year, but in safer, less worrying circumstances.

Next week I have a job interview, and I hear back from two places I interviewed at over the last week. I’ve got my fingers crossed that soon this won’t be a weekly article by a job-seeking entrepreneur, but by a consultant & entrepreneur.

I hope you have a great week.

Callum

Most Interesting Subjects of the Week

Dark Friday and Dirty Fashion

Last Friday was “Black Friday”, the Friday after thanksgiving in the US, or the Friday after the fourth Thursday in November. Around the world this event is celebrated with sales, encouraging customers to spend, spend, spend, and it works. Last Black Friday in the UK, £8.6 billion pounds were spent, and the US spent $7.8 billion USD. That’s a lot of money.

But it makes sense for a lot of retailers to take advantage of Black Friday sales – 30% of all retail sales take place in the month following this day and leading up to Christmas. This year, however, some people are starting to notice, and talk about, the much uglier side of Black Friday.

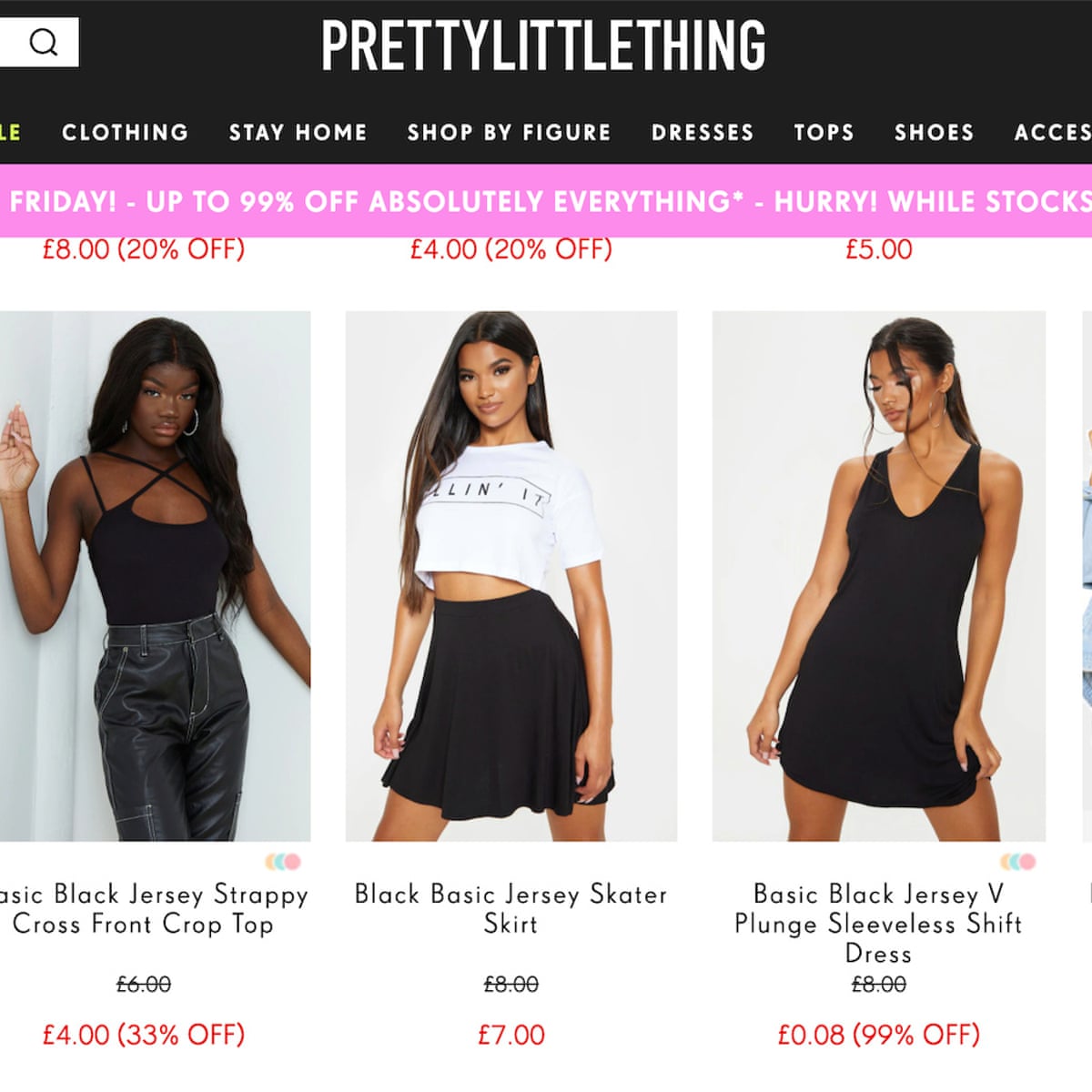

This year Boohoo, a fashion retailer targeting 15-30 year olds, had reductions up to 99% off, selling items like bikinis and dresses for just a couple of pennies. And, rightly so, many, many people were angry about this – selling clothing for this cheap has an effect on the environment, and on the labour conditions of the people who make the clothes.

First, lets dig into the environment. Clothes are either made out of synthetic materials (think nylon, polyester, or acrylic) or natural. Neither of these is good. Synthetic materials are basically plastic – they are difficult to recycle, they don’t breakdown in landfill, and they produce microfibers when we wash them. 35% of all microplastics currently circulating are from washing synthetics. But natural materials aren’t clean either – 1kg of cotton can take 10,000-20,000 liters of water to produce. According to the same report cited before, the textile industry produces as much CO2 than the entirety of the EU.

We are unwittingly wearing the fresh water supply of central Asia and destroying fragile ecosystems.

Fixing fashion: clothing consumption and sustainability, Feb 2019

And our behaviour towards clothing has only gotten worse. Compared with 2000, we buy 60% more clothing and keep it for half as long. The UK buys five times more clothes now than in the 80s and more than any other nation in Europe. The prophecy is self-fulfilling. People buy cheap clothes so they don’t value them, so they don’t keep them for very long – so they buy more clothes sooner, at a cheaper price – retailers look to make clothes even cheaper to meet this demand – the COGS (cost to make goods sold) is reduced through using cheap materials and shoddy craftsmanship – so the products don’t last as long and even quicker than before the consumer is back again for more. The criticism launched at Boohoo was that they were fueling this consumerist fire (80% of the 300 thousand tonnes of clothing disposed of in the UK was incinerated).

And even if, for one moment, we could forget about all of the environmental issues caused by fast fashion, there still remains a discussion about ethics. Boohoo was under fire only recently because of reports that factory makers who make their garments in Leicester were being paid as little as £3 an hour, less than half minimum wage. If your clothes cost less than a pound new, think how much the person who made it got paid. No-one needs clothes that cheap. And we, as a nation, don’t need that many clothes.

Stepping away from the fashion industry, for a moment, Black Friday sales don’t benefit everyone equally. Only big companies with large margins are able to slash prices in dramatic ways, leaving smaller local companies, who have smaller margins and can’t afford to cut prices as much, out of the party. During Covid we’ve been urging people to shop local and support small businesses, but Black Friday does the opposite of that. Retailers bringing in over £1bn see avg 62% increase in sales over Black Friday, where smaller retailers only see 27% increase.

Often, smaller retailers won’t want to take part in Black Friday – marketing editor Elizabeth Tamkin writes that big sales train the customer to wait for sales (37% of UK customers report waiting before Black Friday to spend), which could mean lower revenue for the rest of the year. Many other companies (and nations, sort of) are opting out of Black Friday, making statements about how they don’t think more is better. Bearaby.com actually prevented people from buying anything on Black Friday. For many companies, Black Friday is a good opportunity to show the consumer their values, which can help to build a more trusting relationship between the two.

To conclude this segment on Black Friday and fast fashion, I think we should understand Black Friday really is a dark time for the planet, and fast fashion should be renamed dirty fashion – that’s what it is.

Are Index Funds Too Big?

An index fund is a passive investment fund that invests equally in every company on an index, like the S&P500 or Dow Jones. Index funds don’t try and out-perform the market (that turns out to be difficult, over the past 15 years 92% of large cap funds failed to beat the index), instead they only try to equal the index. This is an attractive and stable opportunity for many, and increasingly so. A decade ago passive funds made up 25% of the stock market. Now it makes up 45%. But this shift in investing has created a quiet shift in power that will need to be addressed at some point.

To see why, let’s think about someone who owns Pepsi stock and Coca-Cola stock. Someone who owns stock in both companies would prefer that these companies don’t focus on competing with each other as this would lead to lower profits for both companies in the short run, and lower profits for whichever company loses market share in the long run. For the investor who owns both, competing is a lose-lose scenario. Instead, they would prefer the two companies focus on turning a profit, and would use their shareholder voting power to influence the companies to do so. In theory, this is anti competitive.

But not just in theory – in practice too. Recent publications have highlighted the anti-competitive effects of common ownership. One study showed that when airlines have common owners, their ticket prices are 3-7% higher. This is why laws exist to barr anti-competitive practice – to protect the consumer. This anti-competitive practice could also harm employees too – if companies aren’t competing for skilled labour then skilled employees aren’t getting paid what they deserve.

One argument in favour of index funds is that they could help the companies they own stakes in to become more ESG (Environment, Social and Governance) friendly, but another question is why would they bother? If one index fund spends time making a company in their index more ESG friendly and more attractive to investors, then every other fund tracking the same index benefits the same amount without spending that money on helping the company.

A problem I have with index funds like this is that they often forget who the ultimate customer is because of a lack of transparency. Pension schemes exist to help workers, these pension schemes invest in index funds, the index funds buy shares in the companies on the index, including the companies that employ the workers in the first place. The funds then push for profit, rather than for competition which would benefit customers, or fair pay which would benefit employees, which gives returns to the fund, which passes returns on to the pension scheme, so that the pension scheme is able to pay the workers when they retire. Why doesn’t the company just pay the workers better in the first place? Since the 70s worker compensation has diverged from productivity, meaning most workers are owed more than they are paid.

I don’t have a solution to this problem. Some have proposed tougher legislation, but I can’t see this solving the problem efficiently. Index funds are one of the most reliable tools available for investors, but they aren’t beneficial to the key stakeholders in the economy. They only serve to benefit those who already have capital, widening already rampant inequality. I welcome a rise in the importance of ESG – the result will probably be that every company has to perform a careful balancing act between each of their stakeholders, including employees, customers, and shareholders.

Being Glue

Some people’s day to day job is to be glue. They bring together disparate parts of the business to collaborate, they help onboard newbies, they write documentation, and they help others to deliver on time. Which is great for the business. But not for that person, if these activities are not in their job description.

There are a couple of issues here. First, management don’t always realise how much glue work needs to be done. Second, management don’t always realise the value of glue work. Combined, some-one well meaning will step up to do the glue work, and won’t be rewarded for the value that they bring. The way to deal with this, at least according to Tanya Reilly, Principal Software Engineer at Squarespace, is to stop doing glue work until you are promoted to a point where it is valued.

Glue work isn’t an issue for everyone. As reported in this HBR article, women are 48% more likely to volunteer for non-promotable work, and are 44% more likely to be volunteered by a manager. And forget the excuse that “women do that kind of work because they are better at it.” a) It’s not true, and b) if women are the only ones who do that work, then they are the only ones that get practice. The solution, in part, is for everyone to be more aware of glue work and who does it. One of the reasons why glue work is spread out so unequally is because so much of it goes on in the “background”, so one of the solutions is to bring it into the foreground.

Longreads

Your brain is not made for thinking. Are you independently minded or conventionally minded? The world needs both, and I can’t recommend the author of that article more. Finally, Uber bought itself a law, and this is why that matters.

I hope you enjoyed this week’s read. If you did, consider subscribing to get it every week, and give it a like wherever you found it.